Simply input the vales of the high, low and closing price of the previous day to calculate the camarilla levels for the present day in the following calculator

- Calculator

- Camarilla Advanced Calculator Formula Sheet

- Advanced Camarilla Calculator Formula

- Online Advanced Calculator

Add Camarilla Pivot Points Calculator to your Website by embedding the following code:

SureFireThing.com supply their online SFT Camarilla Equation calculator for day trading at probably the lowest cost available anywhere. There are a number of other commercial sites purporting to supply a 'Camarilla' equation, but we cannot vouch for any of them, as none would give us a free trial! Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using. Camarilla Equation Levels plots both dynamic and statical event areas of the market to spot the best possible area of maret entry for its users. These levels are being plotted on an automatic basis and you don’t have to bother of drawing manual lines at your trading charts anymore.

Calculation and Formula

The camarilla pivot point is the average of the high, low and closing price of the previous period. Considering this we wish to calculate the today's Camarilla pivot point then we take the average of yesterday's high, low and closing price. Hence the formula is as follows:

Camarilla pivot point = (H+L+C)/3.

As with any pivot point, the most important calculations are for the resistance and support levels. The formulas for the same are as follows:

Supports

- S1 = C - (H - L) * 1.1/12

- S2 = C - (H - L) * 1.1/6

- S3 = C - (H - L) * 1.1/4

Resistances

- R1 = C + (H - L) * 1.1/12

- R3 = C + (H - L) * 1.1/4

- R2 = C + (H - L) * 1.1/6

Meanings of the abbreviations in the above formulas are as follows:

- H = Previous day's high.

- L = Previous day's low.

- C = Previous day's closing price.

- S1 = First level of support.

- S2 = Second level of support.

- S3 = Third level of support.

- R1 = First level of resistance.

- R2 = Second level of resistance.

- R3 = Third level of resistance.

Check out what are Forex Pivot Points.

Other Pivot Point Calculators:

Forex Trading Tools

Enter Forexabode Blog

Enter Forex Abode Community

Forex Rates

Today, I want to talk about a new indicator we have introduced on the Market Pulse app that happens to be one of my favorites and one that you can depend upon for your intraday trading - the Camarilla Pivots.

This article will cover :

- What is Camarilla Pivots

- Benefits of Pivot Trading

- Camarilla Calculations

- Camarilla Trading Strategies

- Benefits of Pivot Trading

- Display of Pivots on Chart

Camarilla Pivots

Most of you are already aware of the Standard and Fibonacci Pivots used widely for intraday trading. The basic building block of these levels are that prices have a tendency to revert to their mean and the trader can use them to make the right entries and exits for profitable intraday trading.

In the classic pivots, traders watch Resistance 1 and support 1 as the crucial levels. In Camarilla Pivot points, traders attach importance to third and fourth levels of Support and resistances as shown in the Fig.

Calculator

Benefits of Pivot Trading

- Prepares the trader in advance with a game plan.

- Levels are generated automatically each trading day.

- Spots trigger points in bullish and bearish areas of the chart

- Clear entry and exit points.

- Identifies support and resistance;

Camarilla Calculations S1 stereo imager vst.

Feel free to skip this section if the math doesn’t excite you.

The input parameters for Camarilla calculations are the Previous days Open, High, Low and Close.

The levels are calculated as follows:

R4 = Close + (High – Low) * 1.1/2

R3 = Close + (High – Low) * 1.1/4

R2 = Close + (High – Low) * 1.1/6

R1 = Close + (High – Low) * 1.1/12

S1 = Close – (High – Low) * 1.1/12

S2 = Close – (High – Low) * 1.1/6

S3 = Close – (High – Low) * 1.1/4

S4 = Close – (High – Low) * 1.1/2

Once a security either moves above R4 or below S4, means a breakout move and a trending move is likely towards R5/R6 on the upside and S5/S6 on downside which are calculated as follows:

R5 = R4 + 1.168 *(R4-R3)

R6 = (High/Low)* Close

S5 = S4 – 1.168 *(S3-S4)

S6 = Close – (R6 – Close)

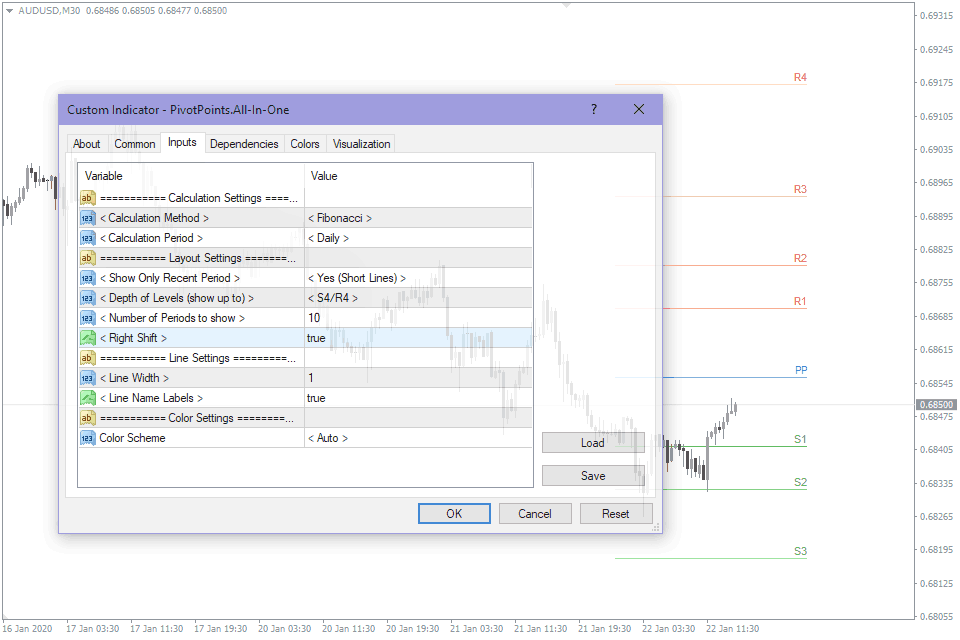

Display of Pivots on Chart

As a user of Pivots, you must be aware that the Pivot points displayed on your chart are calculated based on different data points.

For eg. If you are using an intraday chart up to 15 minutes, the pivot points are calculated based on the open, high, low, close of the previous trading day. If the chart setting is 30 minutes to 4 hours, the pivot points are calculated based on the open, high, low, close of the previous trading week’s data and similarly for daily charts the pivots are from the previous monthly candlestick data.

Camarilla Advanced Calculator Formula Sheet

Camarilla Trading Strategies

There are 4 distinct scenarios that can occur when trading with Camarilla pivots:

- Scenario 1 - Open price is between H3 and L3

- Scenario 2 - Open price is between H3 and H4

- Scenario 3 - Open price is between L3 and L4

- Scenario 4 - Open price is outside H4 and L4

Scenario 1

Open price is between H3 and L3

For Long

Wait for the price to go below L3 and then when it moves back above L3, buy. Stoploss will be when price moves below L4. Target1 - H1, Target2 - H2, Target3 - H3

For Short Sell

Wait for the price to go above H3 and then when the price moves back below H3, sell. Stoploss will be when price moves above H4. Target1 - L1, Target2 - L2, Target3- L3

Scenario 2

Open price is between H3 and H4

For Long

When price moves above H4, buy. Stoploss when price goes below H3. Target 1 - H5, Target 2 - H6

For Short Sell

When the price goes below H3, sell. Stoploss when prices moves above H4. Target1 - L1, Target2 - L2, Target3- L3

Scenario 3

Open price is between L3 and L4

For Long

When price moves above L3, buy. Stoploss when price moves below L4. Target1 - H1, Target2 - H2, Target3 - H3

For Short Sell

When the price goes below L4, sell. Stoploss when price moves above L3. Target 1 - L5, Target 2 - L6

Scenario 4

Open price is outside the H4 and L4

Wait for the prices to come in range and trade accordingly.

Conclusion

Patience and discipline are key. Traders must wait for the levels to be reached before taking action. Once you are comfortable with trading the basic strategy, you can further experiment by combining it with SMA, EMA or the RSI to see if you can further improve your trading performance.

Trivia

Camarilla Pivot points was discovered by Nick Scott in 1989, a successful bond trader.

.jpg)

Famous Nick Scott Quotes

'If it ain’t broke, don’t fix it!

“Do the same dance as everyone else, just learn how to sit down BEFORE the music stops!'

Advanced Camarilla Calculator Formula

'Most traders go broke because they can't adapt. They think they have found the'secret', and may even make money for a while, but then suddenly it stops working. They don't adapt, they just keep on trying the same old(now non-functional) trick until they run out of cash. The reason I'm Nick Scott and you are not is that I adapt on a daily basis. Adapt or die!”

Online Advanced Calculator

Market Pulse is now available on iPhone